Opening a brokerage account is a major step on the path to financial success...

It might feel a bit intimidating at first.

But 99% of the time, the process is easy. In fact, it's often easier than opening a bank account.

Today, folks have more choices than ever when it comes to brokerage accounts and trading platforms. You've surely seen ads for plenty of firms that want you to use their services.

The good news is that it's hard to go wrong with any of the major brokerages. They all offer easy-to-use websites and apps, extensive access to the markets, low (usually zero) trading fees for stocks, and good customer service.

In this guide, we'll walk you through the basics of choosing a brokerage, setting up your first account, and getting started investing.

The first step is simple – it starts with you...

#1. Thinking about your needs and preferences

To help find the best brokerage for you, it's important to ask yourself some basic questions...

- Will you be making trades on your computer (using a website), on your phone (using an app), or both?

- Do you want a trading platform with a ton of features? Or do you want something simple and straightforward?

- How much "hand holding" do you think you'll need? How important is customer service to you?

- Do you plan on trading options at some point in the future?

These questions should help you get a sense of your priorities.

We strongly recommend checking out multiple brokerages before you pull the trigger on choosing one. That will help you get a feel for the differences between them.

For example, some platforms gear their offerings toward experienced traders. As a result, they can be overwhelming for beginners. And you won't get much help with the basics from their customer service teams.

By comparison, some brokers have super-simple apps. The trade-off is that they usually come with fewer features. And you might not even notice that until you start looking for more advanced investment options.

A Great Time to Get Started With a Brokerage

Keep in mind that brokerages are the middlemen between the public and investments.

Before the Internet, you had to use a "full service" broker to buy and sell stocks. You needed to make a phone call to the firm to place an order. And you had to pay hefty commissions on every trade.

But in today's electronic era, things have changed a lot – for the better!

You can now choose from dozens of online brokerages. Their platforms are easy to use. And you can place trades via apps on your phone – from anywhere – in seconds.

If you've never heard of a particular brokerage before, it's best to be skeptical. The safe bet is to stick with companies that have a long history of serving investors.

Finally, when it comes to customer service, a big spread exists. It can vary from excellent to non-existent.

Newer brokerages tend to have extremely user-friendly apps, but they skimp on hiring folks to answer the phones. You should keep that in mind as you move to the next step...

#2. Picking the brokerage that's right for you

As we said, you can now choose from dozens of online brokerages...

First, there's the household names like Charles Schwab, Fidelity, Interactive Brokers, and Morgan Stanley's E-Trade Financial. Plenty of newer firms have popped up over the past decade as well. And most big U.S. banks have also expanded their services to include a basic investing platform for customers.

If you're new to investing, it's probably best for you to stick with one of the big, established online brokerages – Schwab, Fidelity, Interactive Brokers, or E-Trade Financial.

These brokerages all have decades of experience helping customers build and manage their portfolios. They each have user-friendly websites and apps. And they'll provide you with access to a wide range of investment products, along with excellent customer service.

Some other brokerages to consider are...

You might prefer one of these other brokerages for personal reasons.

For example, Merrill Edge might be a convenient option if you currently manage your finances through Bank of America – which is the parent company behind Merrill Edge.

Or if you have a retirement account through a particular firm that also offers investing services, it can be convenient to make a brokerage account in the same place.

Ultimately, there's no single "best" brokerage for everyone. It's up to you to decide.

Fees and Commissions

There's a lot of competition in the brokerage industry. And that's great news for investors.

Brokerages and financial-services firms have easy-to-use websites and apps.

Folks can get access to a massive range of stocks, bonds, mutual funds, exchange-traded funds ("ETFs"), and options – as well as top-notch customer service and easy-to-use trading platforms – with minimal expenses.

And even better, in recent years, every major brokerage slashed their per-trade commissions on stocks to zero. In other words, you can buy and sell stocks for free.

With this "discount" brokerage approach, you use a website or app to invest. That means placing trades yourself (instead of the old way of calling someone on the phone for every trade), depositing or withdrawing money, and accessing tax forms and other documents.

Considering the online nature of it all – and the fact that you do the investing work yourself – it makes sense that the fees are zero (or for certain investments, very low). You can certainly talk to customer service folks for assistance, but it won't be personalized service.

On the other hand, a "full service" brokerage approach can offer more personalized interaction with clients. This can even include in-person human contact, where you can go to an office and talk to someone for help with investing.

You might even be assigned a specific person – who you can call on the phone – to handle your account.

Of course, this kind of service involves more than just using a website or app to quickly place trades. So naturally, it involves higher fees.

Additionally, a full-service broker might try to steer you toward investments with higher fees – all so they can collect more fees themselves. So in that case, you'll want to be careful.

Be sure to check out the websites of a few different brokerages. You can even call their customer services departments with specific questions about their processes. (In this way, you can also get a feel for how they treat customers – which can be a dealbreaker.)

If you plan to handle your trades using an app on your phone, you could download a variety of trading apps to get a potential feel what some basic aspects of the interface look like – even before you open an account.

Think about it this way...

If you hate the user interface, it will make every trade feel like a chore.

Depending on the brokerage and type of account, you might need to meet a threshold for minimum annual income. Or you might need to put a minimum amount of money into the account.

With so much of the investing process online these days, many brokerages feature educational materials on their websites. It's always good to learn as much as you can.

In many cases, you can access a lot of this content before you even open an account. (Of course, once you open an account, research on specific stocks can also be available.)

The amount of educational material can help with a decision to pick a brokerage firm.

And then, once you've picked the right brokerage for you, it's time for the next step…

#3. Opening your first account

Setting up a brokerage account should take about 10 to 20 minutes. And as we said, these days, you can do it all online by going right to the brokerage firm's website.

Somewhere on the page, you'll find a big (and probably brightly colored) button with some variation of "Open an Account" on it. Simply click that button and follow the instructions.

Before you can put money into your account, the brokerage will ask you for some basic info. It's basically the same details a bank would ask for...

- Name

- Address

- Social Security number

- E-mail address

- Phone number

The brokerage will probably also ask about your employment and tax status.

If the questions feel a bit annoying, don't take it personally. All brokerages need to comply with strict regulations – especially when it comes to anti-money laundering ("AML") laws.

Next, you'll need to choose an account type.

At the most basic level, you would be setting up an individual, taxable account.

The brokerage will probably ask if you want to open a "margin" account. Margin is a fancy word for borrowing money to make trades – so keep in mind that it's higher risk than most folks like. A safer approach is making the account "cash" or "cash only."

Either way, make sure to carefully read the explanations for each account type. You'll want to pick the one that matches the style of investing you want to do.

Keep in mind, as we mentioned earlier, you can have multiple accounts at the same brokerage. For example, you could have a taxable account, traditional IRA, Roth IRA, and a 529 account (for a child's college fund) managed by a single company.

The main difference here involves taxes. Retirement accounts like IRAs allow you to defer taxes on your gains. You won't need to include those accounts when you file your taxes. The trade-off is that contributions to retirement accounts have strict limits.

You can put as much money as you want in a taxable account. And most brokerages make it easy to input the year-end tax info into any tax-preparation program you use to file taxes.

Please remember that we're not tax experts...

Retirement accounts like a traditional IRA or Roth IRA may be subject to restrictions for types of trading due to their tax status. As such, it's best to contact a tax adviser to work out your specific approach for planning for retirement.

Once you've answered enough questions, it's time to fund the account...

It's easy to connect your new brokerage account to an existing bank account. You'll need the account number and routing number for the bank account you want to use.

Once that's set, you'll be able to easily move money back and forth between the accounts.

In fact, most brokers allow you to schedule regular deposits over time. For example, you can have your brokerage account automatically pull $100 a week from your bank account. It's a handy feature to help ensure you always have some funds on hand.

A basic brokerage account will give you access to plenty of stocks, bonds, mutual funds, and ETFs. To trade options, you'll need to go through an extra step – which we'll cover next.

If you don't care about options (at least, for now), you can skip over this next section.

#4. Opening an options account

To get access to options trading, you'll need to fill out an extra application before the brokerage will "approve" your account. Be ready to answer more questions...

Options come with higher risk and reward. They can be highly profitable for experienced traders. But novice investors can lose a lot of money if they don't know what they're doing.

To make sure you're competent, the brokerage will ask for more background info...

- How long you've been investing

- Your net worth

- Your annual income

- Your investment objectives or goals

The brokerage will also want to know what kind of options you plan to trade. At Chaikin Analytics, we keep our options trading simple by only buying calls – like we just described in the box above. Select "buy call options" and ignore the rest of the choices.

Once you've completed the options application, the process should go smoothly. After reviewing your answers, the brokerage will assign you a "trading level" between 1 and 5. The higher the level, the more access you'll have to riskier option strategies.

For our purposes, level 1 or 2 is fine. We just want the ability to buy call options – so make sure your broker understands that's your goal.

#5. Making your first trade

As long as you're not mailing a check to fund your new account, your money should appear in the new account within a few business days.

Then, you're finally ready to buy your first stock.

This step is probably the easiest one we'll cover. All the major brokerage platforms are easy to use. Just type in the stock ticker and hit "Search."

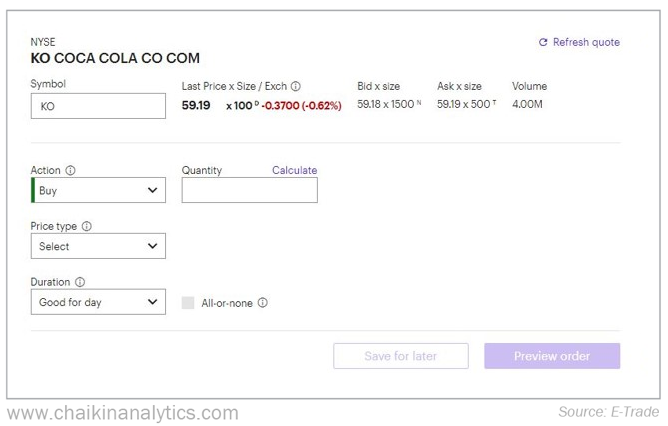

You'll see an order box that looks something like this screenshot (from E-Trade's platform)...

In this case, we're looking to buy snack-and-beverage giant Coca-Cola (KO). But please keep in mind that this is not a recommendation and the prices shown may not reflect current prices. We're just using Coca-Cola because nearly everyone knows the company.

As you can see, we've entered the ticker in the "Symbol" box.

Our basic "Action" choices are "Buy" and "Sell." (You'll also find a few other choices in the dropdown menu. But those options are beyond the scope of what we'll cover here.)

Next, we need to decide how many shares to buy...

Let's say we want to invest $1,000 in KO. We'll take $1,000 and divide by the share price (at the time of this screenshot, around $59). That works out to about 17 shares. So if we buy 17 shares of KO, we'll need roughly $1,006 (17 x $59.19 = $1,006.23).

For "Price type," the simplest choice is "Market." This means you're willing to pay the current price of the stock.

The only other notable price type is "Limit." That option lets you specify the price you buy or sell the stock. For example, if you wanted to buy KO shares for cheaper than around $59 – say, $55 – you would choose "Limit" for the price type.

An extra menu box will pop up. In this box, you would enter $55 as your limit price. Once you submit the order, it will remain open until it either gets filled or expires (based on the time you choose in the "duration" box, which we'll get to shortly).

Here at Chaikin Analytics, when we discuss buy-up-to prices in our newsletters, we're referring to a limit order. We're specifying the highest share price we recommend paying.

The duration choice isn't important when you place a market order. It's only useful when placing a limit order. Again, let's say you want to buy KO shares at a limit price of $55. If you choose "Good for the day," the trade will expire when the market closes that day (4 p.m. Eastern time).

It's highly unlikely KO would fall from $59 to $55 in one day. But if you're willing to wait, you can choose "Good till cancelled," which means the order will remain open until KO shares hit $55 (and the trade gets executed automatically) or until you cancel it.

Most platforms will show a preview of the trade before you finalize it. Double-check the numbers. Once you hit the "Confirm" button, you won't be able to change your order.

If the trade meets all your criteria when you confirm it, it should execute immediately. But if you've entered limit prices or other specifics, you might need to wait for it to happen.

In either case, you can check on the status of your order to see when (or if) it filled.

Let's say you went with a market order. In that case, the trade would've filled right away at the current share price around $59. You're now the proud owner of 17 shares of KO!

Wrapping Up

In this guide, we've explained five steps for getting started with investing...

- Thinking about your needs and preferences

- Picking the brokerage that's right for you

- Opening your first account

- Opening an options account

- Making your first trade

Once you've opened your account...

Congratulations! You're on the road to a lifetime of wealth-building in the stock market.

Here at Chaikin Analytics, we're here to help you achieve that goal.

So thank you for making us part of your investing journey.

Good investing,

Chaikin Analytics